Validation is the backbone of trust. It’s how decentralized systems ensure security, transparency, and reliability. Without it, the promise of trustless networks would fall apart. Validation also creates opportunities for users to actively participate in securing the network—and earn rewards in the process.

Like most things, there’s more to it under the hood. The challenge, however, is that much of the depth can get highly technical. Validation is a crucial concept in the blockchain industry, and this article aims to break it down from a foundational perspective.

WHO ARE VALIDATORS

Validators produce the BLOCK in BLOCKchain. They are simply computers that have been configured to the network (Solana, Ethereum, etc) it’s operating on to actively produce and validate transactions in bulk. 100% of the time there is a team of engineers ensuring that these validators are active 24/7 and producing blocks. They are on standby to troubleshoot any issues that might disrupt that goal.

WHY DO WE NEED THEM

For 3 major things:

Verify and confirm true transactions

Reject false transactions

Staking rewards

Now the first two are self-explanatory, but don’t get me wrong though they are very important. For example, a user trying to send 10 bitcoins with 0 bitcoins in their wallet, would be false and shouldn’t go through. The good news is we don’t have to worry about that. We have professionals in the space working round the clock to ensure 100% uptime of these nodes.

STAKING REWARDS

Staking presents an opportunity for people who can’t handle the hassle of running and maintaining a validating node to participate in the network mechanism and also earn rewards!

It works by buying x amount of tokens of the underlying network, Solana for example, and then locking those tokens with a validator of your choice. And that’s it.

Some platforms allow you to withdraw anytime, but of course, the longer you lock your assets, the higher your rewards. It’s okay to wonder if these validators can produce yields on your hard-earned money.

From my experience working closely with practically all the major validators in the space I can say for sure that this is a huge market.

As of 2020, the market capitalization of staking was $35.8B around 13.5% of the total crypto market cap which was $270B. As of Q1 2024, the total market cap of crypto has grown to $2.8 trillion dollars, do the math!

There are some things you should know before getting too excited.

DISADVANTAGES OF STAKING

As with most industries, staking comes with its own set of red flags worth considering, such as:

Illiquidity

When you stake, you’re essentially committing—it’s like putting your assets in a savings account with no access until the term ends. While this can be a great way to earn passive income, the trade-off is liquidity. Staked tokens are locked, meaning you can’t use them for other opportunities, whether that’s a sudden market dip to buy more or a life situation where you need cash quickly.

Even when you decide to stop staking, many networks introduce an unbonding period, a delay before you can access your tokens. For some projects, this can take days or weeks, leaving you in limbo if market conditions change.

Price Volatility

Here’s the kicker about staking: while you’re earning rewards, the value of the token itself can fluctuate wildly. Crypto markets don’t sleep, and staking doesn’t shield you from those price swings. Imagine staking a token for a 10% annual reward only to see its market value drop by 40%. In that scenario, your rewards wouldn’t even come close to offsetting the loss in value.

Staking works best when the token holds steady or increases in value, but in a volatile space like crypto, that’s not always guaranteed.

Slashing Risks

One of the lesser-discussed pitfalls in staking is slashing—a mechanism where a portion of your staked assets is taken as a penalty. Slashing typically happens when validators misbehave—double-signing blocks, going offline, or violating network rules.

The risk is directly tied to your actions if you're running your validator. But even as a delegator, the validator you choose plays a huge role. If they make mistakes, your stake is on the line too. It’s a layer of responsibility that not everyone considers upfront.

One that is of major concern for me as regards native staking

Centralization Concerns (capitalism is that you?)

Over time, large token holders or institutional players can dominate staking pools, consolidating control over the network. In Delegated Proof of Stake (DPoS) systems, voting power is often skewed toward the wealthiest participants.

This concentration of power can reduce the diversity of validators, making the network less resilient to attacks or mismanagement. This is very far from fair for a system designed to be distributed and fair.

Those were not to scare you but to give you the full spectrum of what staking is all about. Regardless of the hurdles, thousands of people are actively staking and earning great rewards. Not only that but staking as a delegator on a network gives you voting power.

This means that you can directly influence the decision-making process of the project. A lot of people look past this point but I want to draw your attention to it.

There are many products we patronize from day to day for example coca cola. You might love the taste and all but often fantasize about the possibility of perhaps a lemon version of the drink. That idea would most likely not leave your thoughts let alone get to the company’s notice.

With voting power, your voice can be heard, and not only that, your opinion can shape the direction of the product. I think this is awesome.

How Can I Participate?

Find a Validator

This step is split into two lanes. You can choose to single out a validator node of your choice and stake with them (Native Staking) or you can stake on a staking platform that delegates your tokens to several validating nodes to earn the highest interest (Liquid (Re)Staking).

I will walk you through both lanes.

LANE 1: NATIVE STAKING

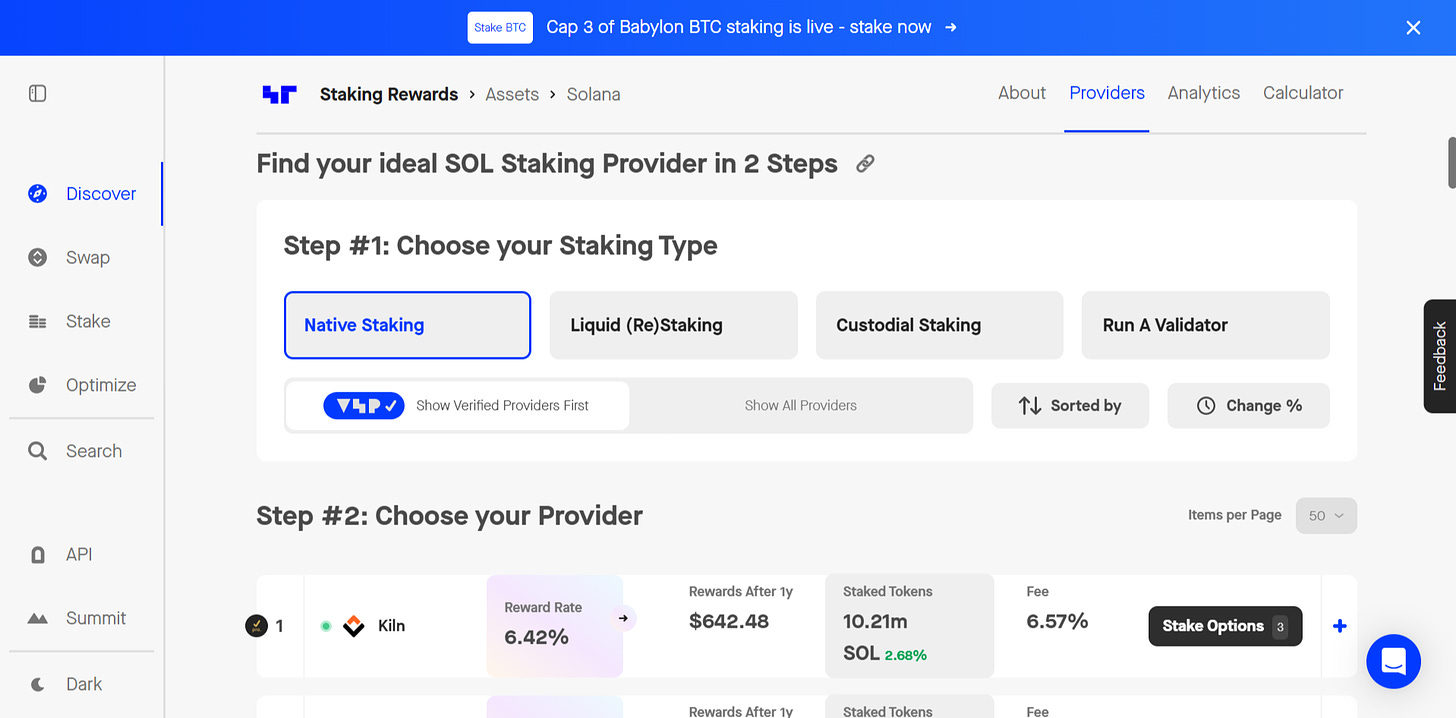

Go to Staking Rewards app

Select the asset you wish to stake. (E.g Eth, Sol, etc)

Select Native Staking

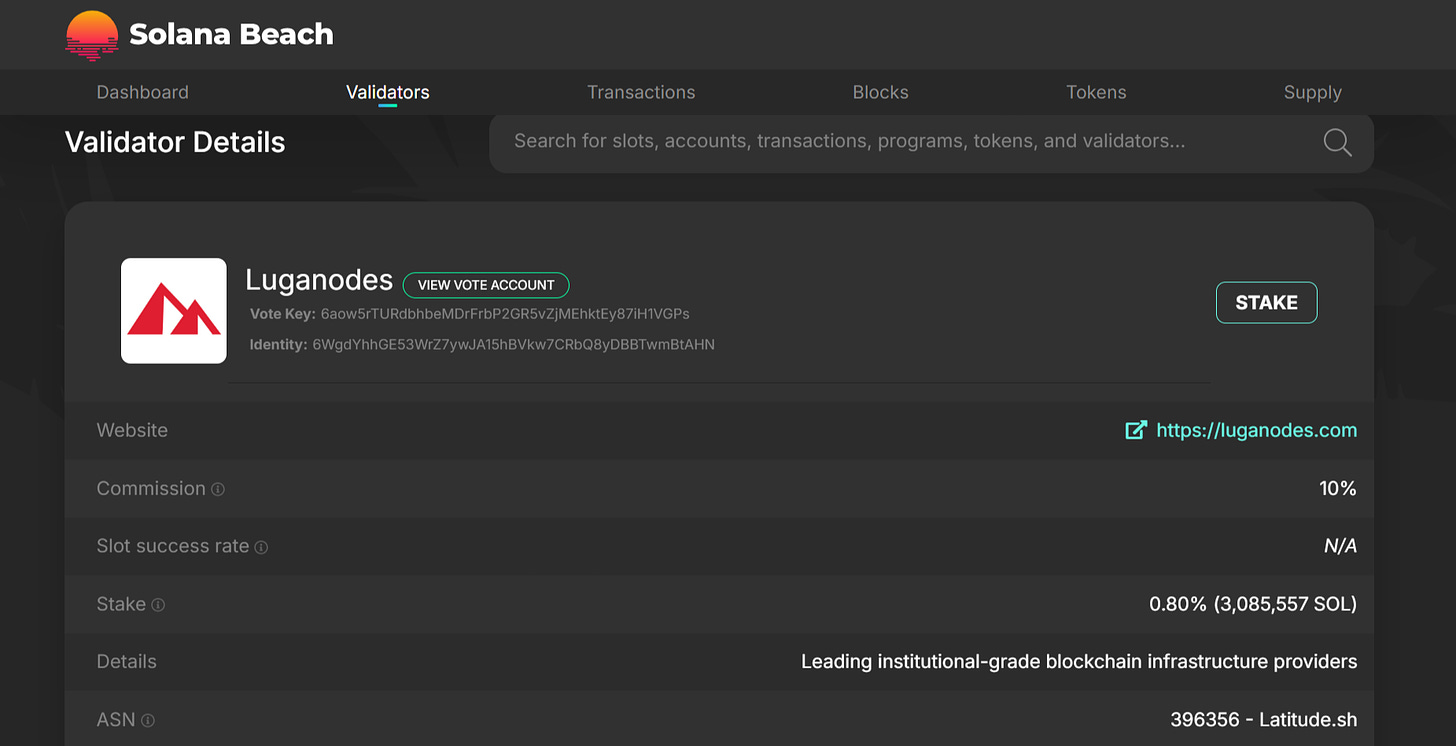

Select your preferred provider (validator). For example Luganodes

Click on stake now

You will be redirected to the validator page

Click on STAKE

You will get a prompt to connect your wallet

Approve the connection and that’s it

LANE 2: LIQUID STAKING

This author would advise this option because of the extra benefits you stand to gain as well as the flexibility that this option provides. The crypto space has been evolving rapidly, especially for ecosystems like Solana.

We have a host of amazing liquid staking platforms that automate your asset across hundreds of the best-performing validator nodes to secure us juicy rewards.

In summary, there are 2 major reasons why this type of staking is advised.

NO Unbonding period

Liquid staking tokens can be immediately swapped for their underlying staked assets, you don’t have to wait for the regular unbonding period to unstake your tokens. Once you stake your asset, you will be given an equivalent token that serves as a receipt.

You can swap the token back to your asset at any time you want and also delegate it to other defi platforms to earn extra rewards.

Reliance on a single validator

Diversifying across multiple validators minimizes exposure and serves as slashing insurance against the mal performance of individual validator nodes. With a liquid staking solution, you can delegate your SOL to a multitude of validators rather than just one.

GUIDE

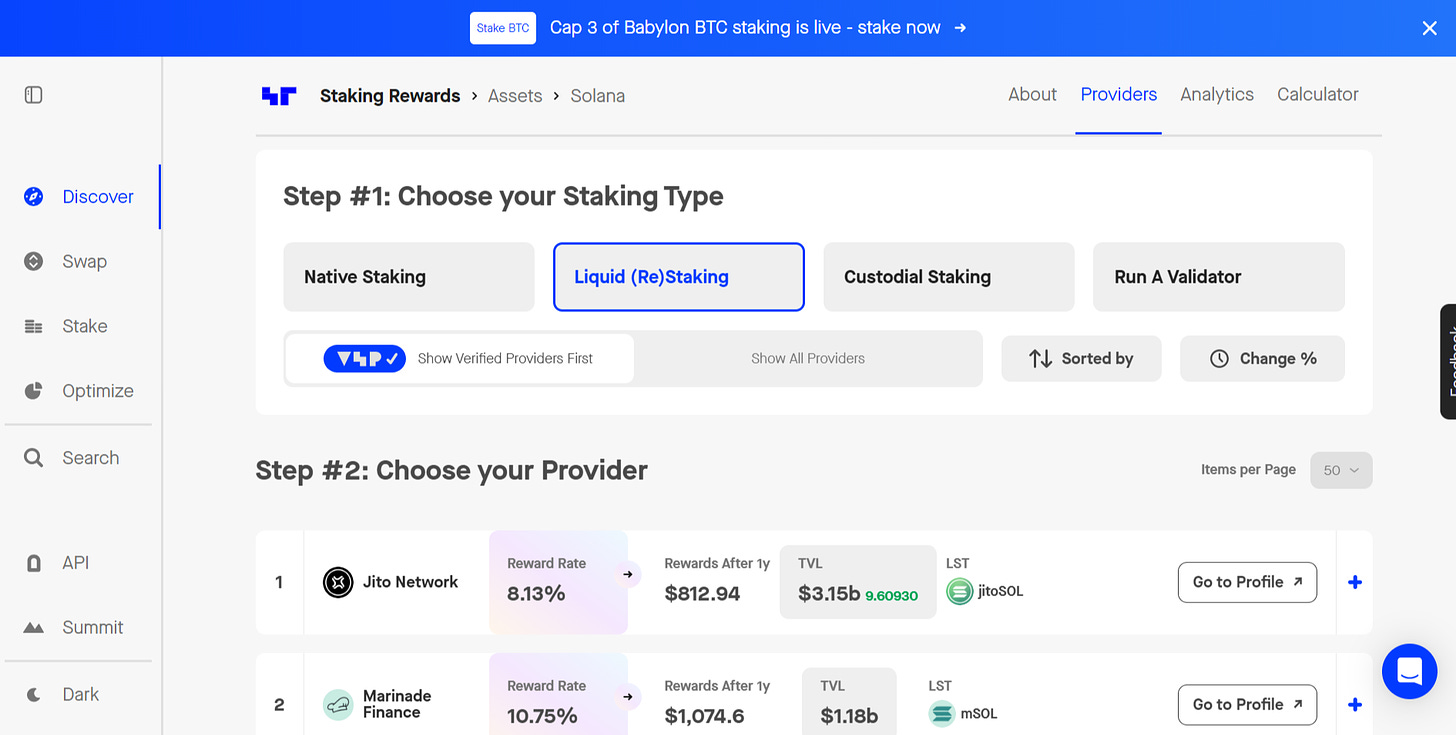

Go to Stakingrewards

Select the asset you wish to stake. (E.g Sol)

Select Liquid Staking

Marinade Finance is a great option if you don't know which to choose from, they are the first liquid staking platform on Solana and arguably the best. Website: https://marinade.finance/

Click on 'Go to Profile'

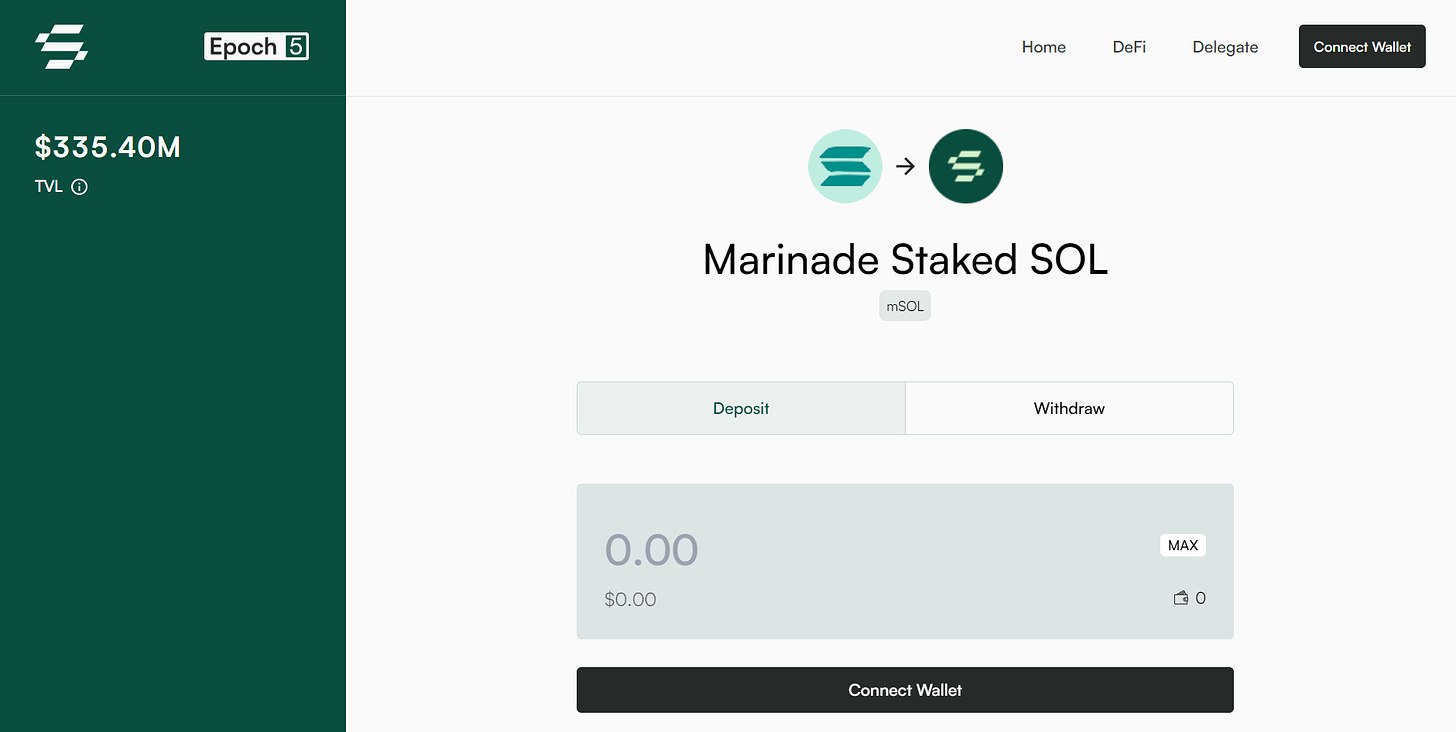

Click on 'Stake Now'

Click on Connect Wallet

Input the amount of sol you want to stake

Approve the transaction and that’s it!

Staking is a powerful way to engage with blockchain networks, offering rewards and deeper participation. But like any opportunity, it comes with trade-offs. Understanding both the benefits and the challenges ensures you’re staking smart, staying flexible, and contributing meaningfully to the decentralized future.