Marinade: Deep Dive

There are certain events I call Ripple Effect events. Events that sprawl a chain reaction of innovation across entire industries. The ripple effect event of our interest in this article would be the 2021 Solana x Serum hackathon. At this time there were a growing number of great implementation projects harnessing the power of Defi on Solana. But staking however was done 'traditionally'. As simple as that might sound this was posing a huge drawback for both the decentralization and growth of the Solana ecosystem at large.

One of the best avenues to grow a blockchain is having channels at which users can utilize their assets via Defi protocols. Defi being arguably the most trusted implementation of decentralization also comes with economic advantages for the underlying blockchain where these Defi protocols run transactions. With about 390,000,000 SOL tokens locked via traditional staking, that's a huge number sitting idle in the hands of validators. A holistic blockchain economy encompasses a flow of assets. Think of it as an ocean, with the increase in APY's and Yield farming on one side of the sea bank and the generation of healthy fees for the protocols and blockchain on the other side of the bank.

Solana hackathons are breeding grounds for creativity, collaboration, and innovation. In the midst of it, our 'Ripple Effect' event was orchestrated when Marinade Finance met Lucio Tato and Marco Broeken who were then spearheading Smart Pool which also aimed at solving the traditional staking mechanism on Solana. Two halves of a cohesive puzzle connected, forming a team that combined their skills, expertise, and a shared vision... LIQUID STAKING.

As of today 20-08-23, according to stats from DefiLlama, Marinade finance comfortably dominates 46.74% of the $306.89m Solana's Defi TVL(Total Value Locked).

Yet, what sets Marinade Finance apart isn't just their visionary approach; it's their resolute commitment to preserving the decentralized ethos. Unlike many, they stood their ground without ceding control to traditional venture capital funding. I found this particularly impressive because the truth is most web3 protocols today trade their autonomy for financial backing in an instant in fact, I have reasons to believe many founders begin building specifically to cash out from VC funding. This, in itself, positions them as the single largest decentralized entity on Solana —a testament to their dedication to the principles that underpin blockchain.

I devoted countless hours delving deep into their whitepaper, meticulously dissecting every detail, and engaging the team with a barrage of questions. My goal was to unravel the intricate mechanics concealed beneath the surface. This thorough exploration lays the foundation for us to uncover the unique value proposition of the protocol and perhaps its flaws as well.

Let's turn to their pièce de résistance - Liquid Staking/Native Staking and the Delegation strategy.

The Buffet Called LIQUID STAKING

i. Traditional Staking:

Imagine a kitchen where customers pay for their pizzas and then patiently wait for their orders to be prepared and delivered. In the traditional staking scenario, Customers(USERS) provide their Payment(SOL) to the Kitchen(PROTOCOL) and then entrust the Chefs(VALIDATORS) to craft their Pizzas(REWARDS). These pizzas are prepared and kept warm, but customers don't have the liberty to enjoy them until the chefs deem it's time. The chefs, in turn, earn their share by participating in the pizza-making process.

The problem here is this process does not better support the flow of assets. Once you stake your Sol, you CANNOT access them until after several epochs.

Epoch means a PERIOD IN TIME.

1 epoch typically takes almost 3 days

Usually, this would take upto 30days. It is impossible to withdraw your funds urgently during this period.

Also, as a user, you are made to choose between staking your Sol for rewards or using your Sol on incentivized Defi platforms. Who says you can't do both? Well, certainly not Marinade.

MARINADE LIQUID STAKING

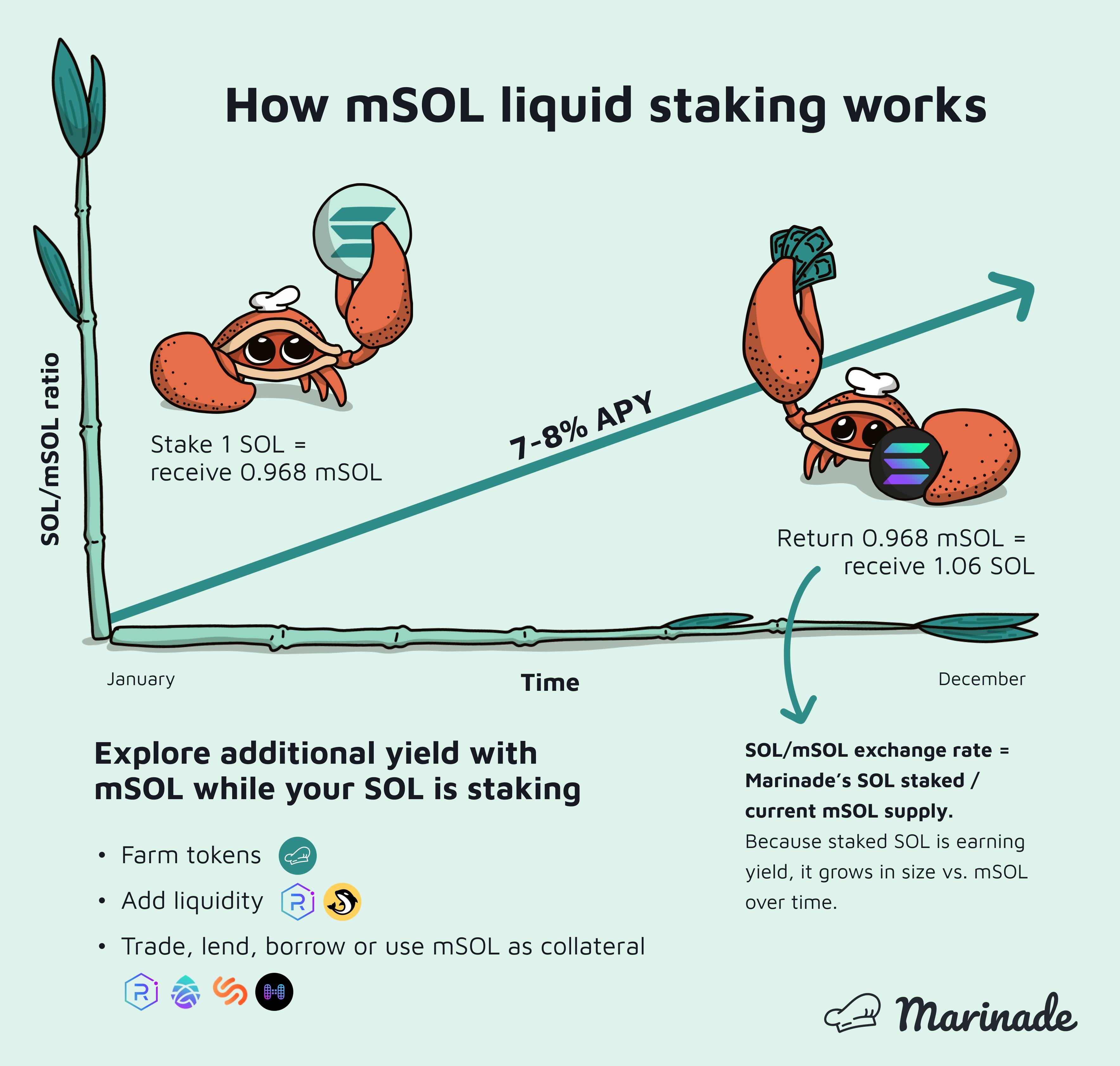

Now, picture an updated kitchen where the process is more dynamic. Customers place an order and, in return, receive not just a pizza but also an equivalent voucher (mSOL). This voucher is unique because customers can freely use it at other gourmet restaurants (DeFi platforms) within the culinary landscape. They can add their voucher for a dish, e.g. adding liquidity to an Automated Market Maker (AMM) like Raydium or use it as collateral for a gourmet loan on Solend. Meanwhile, the kitchen (protocol) takes their initial payment (SOL) and begins crafting their orders, while customers keep their vouchers close and accessible, available for immediate use or trade. While customers relish the rewards of their mSol vouchers, they're also empowered to access their original payment (Sol) whenever they desire.

The chefs (validators), on the other hand, are hard at work preparing the ordered pizzas (staking rewards). Unique selling point: customers' original payment (Sol) isn't just idly waiting; it's meticulously delegated to the top-notch chefs (validators) who ensure that, as time goes on, more rewards are being baked. Think of it as the chefs simultaneously cooking new pizzas while managing the orders they've received.

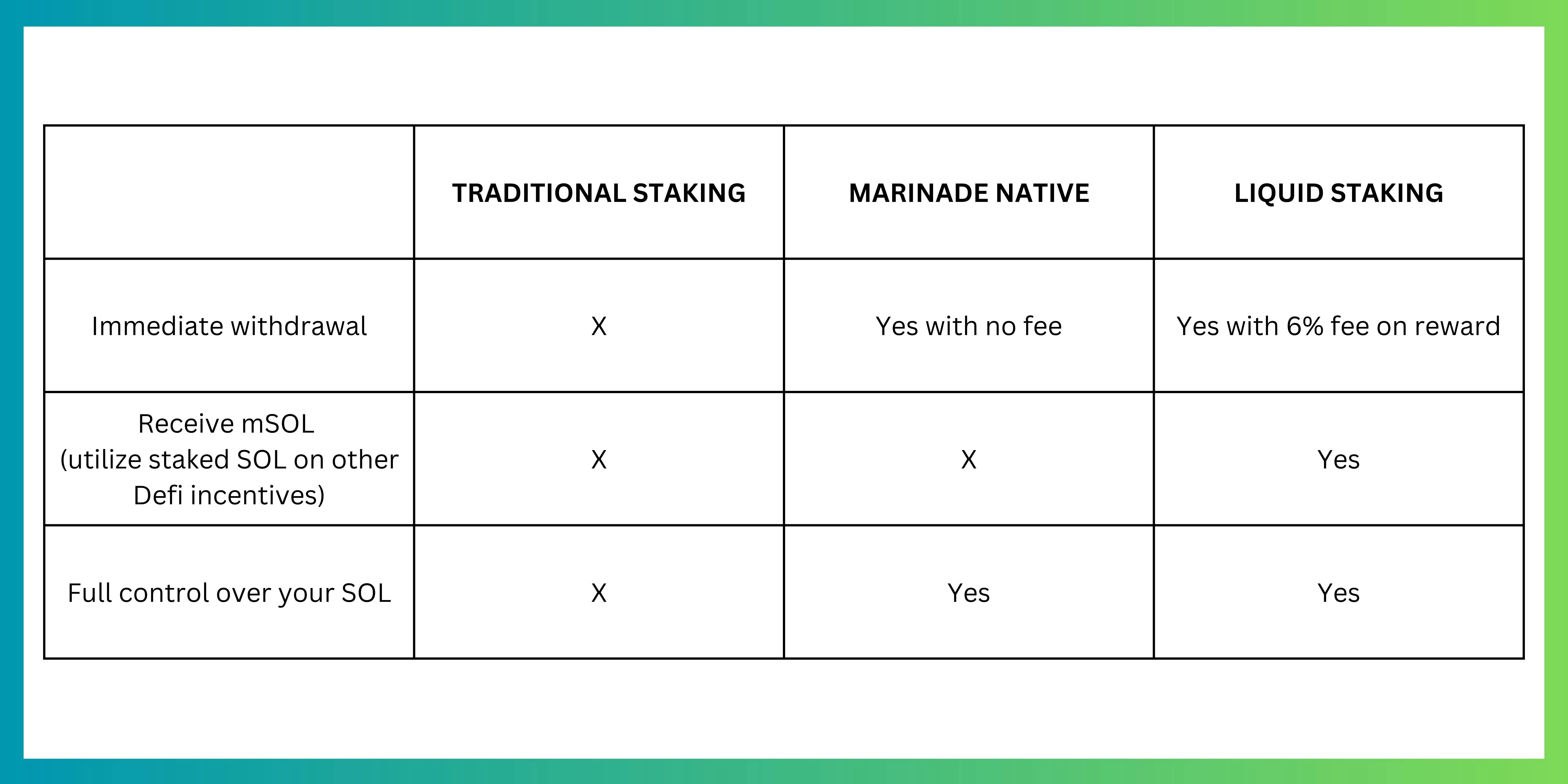

In cases where customers have an urgent craving for their initial payment (Sol), the kitchen smoothly accommodates, allowing immediate withdrawal. For this prompt service: a small fee of 6% of the accumulated rewards is levied. So for example, If you stake 100 SOL for 1 year with a staking return of 7%, you would have earned 7 SOL with your rewards. Marinade takes a 6% commission on those rewards each epoch, amounting to 0.42 SOL and you are keeping 94% of the reward (6.58 SOL).

That's only for mSOL! If you use Marinade Native, there is currently 0 fee

$mSOL

You receive mSOL by liquid staking SOL which is a representation of your accrued SOL (SOL + rewards). I absolutely love this token for 2 major reasons:

1. Diversification of DeFi Participation:

mSOL acts as a versatile key that unlocks various DeFi opportunities. By holding mSOL, you gain access to a wider array of platforms and applications within the Solana ecosystem. This diversification allows you to engage in lending, borrowing, adding liquidity to AMMs, and more—all with the same underlying mSOL token.

2. Amplified Rewards Experience:

Engaging with DeFi using mSOL adds an extra layer of flavor to your rewards journey. By incorporating mSOL, you're enhancing the value of the rewards you earn. Think of it as a seasoning that brings out the best in the flavors of your financial interactions, making your DeFi experience all the more satisfying.

NATIVE STAKING

I will be sticking to the kitchen analogy to also help us simply understand this. Say you're in a culinary world where you have two distinct ways to enjoy a meal. One involves dining at a fine restaurant where expert chefs craft exquisite dishes for you (we already discussed this). The other lets you take the culinary reins and create your pizza in your kitchen. Similarly, Marinade Finance offers both liquid staking and Marinade Native as two distinct dining experiences.

Marinade Native powered by the delegation strategy is like having your very own secret garden, where you cultivate your ingredients from the ground up. In this scenario, you're not depending on a chef's (validator) expertise; you're embracing the innate capabilities of Solana's technology. It's akin to personally selecting the freshest ingredients (validators) from your garden for an exquisite meal. You always have custody and authority over your original ingredients (SOL). Your ingredients are under your watchful eye, and you can decide when to use, savor, or take them back.

Fee Structure and Exit Options

Unlike the complexities of liquid staking, Marinade Native keeps things straightforward. There are no hidden charges—no upfront costs or ongoing fees. Exiting your culinary venture is equally uncomplicated. If you're willing to wait, there's no fee to exit after a cooldown period.

Under the hood

Personalized culinary stations are set up (Solana stake accounts) within your kitchen, and then entrust Marinade Finance to orchestrate the flavors within each account, much like employing a culinary consultant.

At the end of each epoch—equivalent to savoring a meal every 2-3 days—rewards are directly delivered to your personalized culinary stations (Solana stake accounts).

The baking formula - DELEGATION STRATEGY

At the heart of Marinade's native staking lies the Delegation strategy. An algorithm crafted by the team to handle all the important things a user would worry about and more. Think of this as a coach who ensures that the chefs are at their best at all times. Overseeing the kitchen, making sure all chefs (validators) are following standard cooking etiquette, and delegating the best 100 chefs to users who native stakes. It's also the iron fist of the protocol. Let's assume a chef is trying to cut corners by delivering uncooked Pizza to users or charging more than usual (maximum commission must be less than 10%), such a chef would be blacklisted as this is seen as harming the network.

Other harmful activities that would restrict a validator from staking users' SOL include:

Failing to restart the node in the 36 hours following the cluster restart after a halt at least 2 times.

Slow voting (also called vote lagging).

From my findings, commission rug is a murder offense. A validator caught doing this is given 0 chances and permanently blacklisted from the network.

It's an algorithmic sous-chef that constantly refines, balances, and adjusts your delegation to extract the most flavor from the validator

—the Delegation Strategy Pipeline. Simply put, let's say it is a well-calibrated culinary process, where each step enhances the final dish. Just as a chef carefully selects ingredients to craft a masterpiece, Marinade's Delegation Strategy Pipeline meticulously navigates the validators to ensure optimal rewards and security.

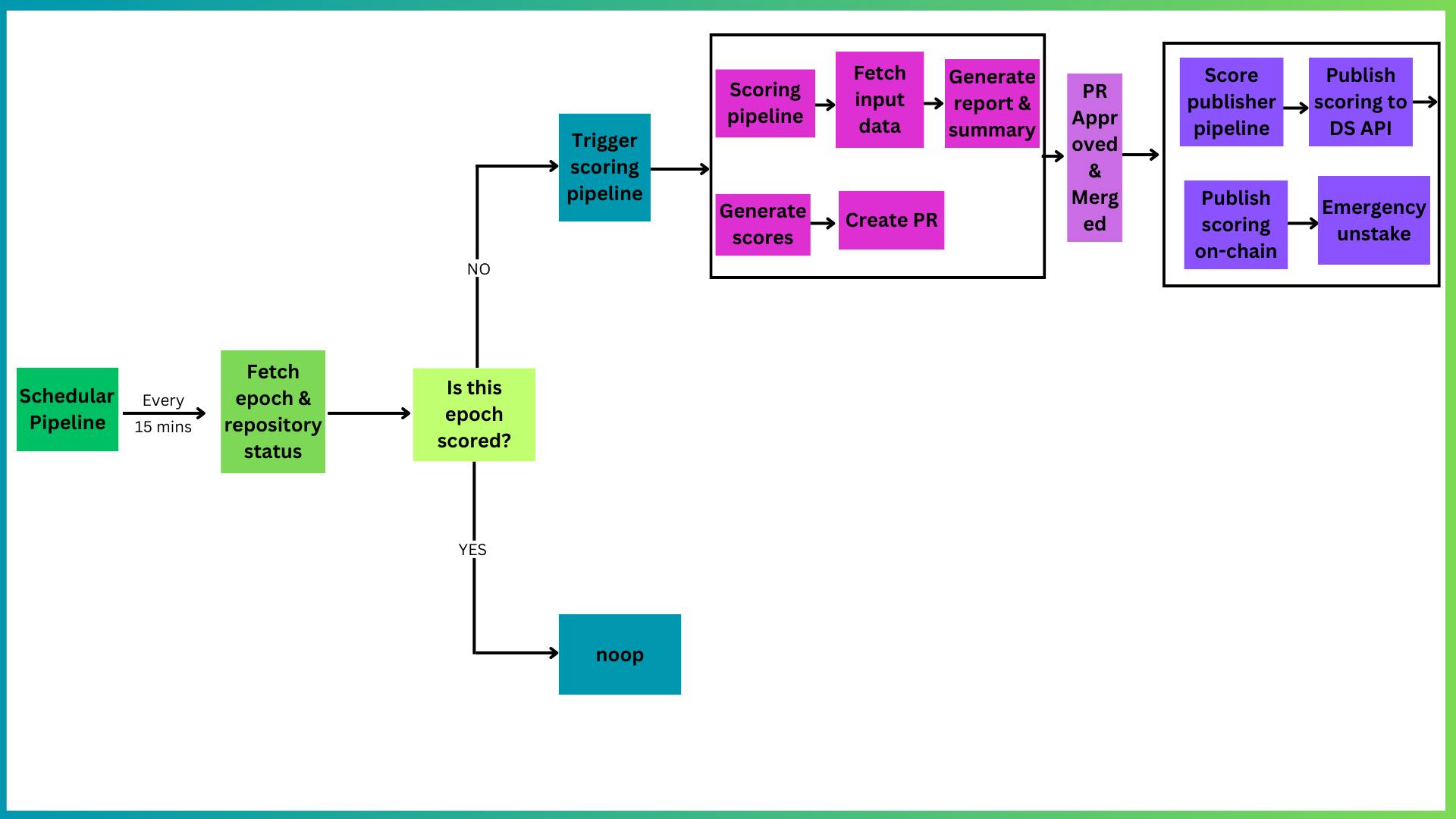

The below image is a visualization of a high-level overview of the pipeline process. Available on their github, however, I tried making it easier to understand. It's okay if you don't understand it though, only developers usually do (nerdy stuff).

Validators are required to stake at least 1000 SOL in the past 10 epochs and be among the top 100+ validators by score. Remember, the entire protocol is 100% decentralized meaning Marinade does not hand-pick validators in the top 100 because they are their personal favorites. So how does the strategy ascertain these scores? It does this using 3 metrics.

Performance based

Directed stake (more on this shortly)

$MNDE voting based (and this)

To sum this all up, the algorithm ensures every validator is not breaking any rule every epoch and would take swift action at any point a validator flaunts any of its rules. The algorithm takes into account the best-performing 100+ validators and shares the users staked SOL amongst them for earning rewards, this makes up for 60% of their score.

The remaining 40% is split equally between directed stakes and MNDE votes to include the choice of the users.

DIRECTED STAKING

To understand the significance of directed staking, let's take a journey back in time to the early days of blockchain and cryptocurrency. In the nascent stages of proof-of-stake (PoS) networks like Solana, staking was a relatively straightforward process. Users would delegate their tokens to a validator, entrusting them to manage the technical aspects of maintaining the network and earning rewards.

As PoS networks gained traction, a challenge emerged—how to ensure that users had more control over where their tokens were staked and who was validating transactions. The concept of directed staking emerged as a response to this challenge.

In the early days, users had limited autonomy in choosing validators. Delegation often happened through a centralized mechanism, where a single entity would manage large pools of staked tokens on behalf of multiple users. This approach had its downsides, including reduced transparency, lack of control, and potential centralization of power within the network.

Marinade Empowering Token Holders

Directed staking was born out of the need to empower individual token holders. It recognized that token holders, who were actively invested in the network's success, should have a say in the validation process. By introducing directed staking, users gain the ability to select validators they believe in, aligning with their values, technical competence, and operational transparency.

Both $mSOL and $MNDE holders can choose which validator they want to stake with. This is another area where the team has shown great economics as this process makes it possible for validators who aren't exactly top 100 to gain a chance at validating SOL as well. Little wonder why this protocol is the largest Defi project on Solana by TVL.

Enhancing Decentralization:

Directed staking is a watershed moment in the journey toward decentralization. It helps address concerns about centralization by enabling a distributed network of validators that were chosen by a diverse array of token holders. As more participants engage in directed staking, the network becomes more resilient and less susceptible to a single point of failure.

Democratic Validation:

Historically, directed staking marked a shift from validators being chosen by a few centralized entities to a more democratic process. It allowed individuals, regardless of their technical expertise, to actively participate in the network's governance by selecting validators who shared their vision for the blockchain's future.

salt&pepper - $MNDE / DAO GOVERNANCE

Just as a gourmet feast is enhanced by the input of passionate chefs, Marinade DAO Governance empowers participants to influence the evolution of the protocol, from its offerings to its very essence. Users gain voting right by locking $MNDE tokens in Realms to obtain veMNDE.

Realms provides a platform for builders on Solana to create a DAO, manage their members, vote on proposals, and allocate their treasury.

A Dynamic Framework for Decision-Making

Ever wanted to have a say in which ingredients make it into the recipe of your favorite? Now's your chance! Anyone can present proposals, from introducing new tokens to tweaking protocol parameters.

When a proposal is on the table, each member's vote carries weight, regardless of the size of their stake. It's not about who has the most tokens; it's about everyone's input. Whether you're an experienced validator or a first-time user, your choice is a critical ingredient in the decision-making recipe.

My key takeaway here is that every member has a voice, and collective wisdom shapes the path of the project forward. It's an interactive process that transforms Marinade Finance from a static platform into a living ecosystem where change is a joint endeavor.

My Verdict: A Culinary Evolution in DeFi

As I reflect on the journey of Marinade Finance, it's evident that we've come a long way. Two years since Solana's first liquid staking platform launched, Marinade stands tall, with a reputation that's been earned and cemented. Of course, there has been competition, however, Marinade remains the best liquid staking platform on Solana. The secret? Perhaps their APY of 7-8%, a standout in the market. Or my personal favorite, the mSOL-SOL-LP liquidity pool. The pool has 0 impermanent loss which is mind-blowing!

Yet, even though they've secured their position at the forefront, there's room for growth. The user experience, while functional, could be elevated to match Solana's reputation for seamless interactions. I had so many questions during my experience with the product, moving zig zag and trying to grasp the full offering of the product. This would definitely be a daunting task for newbies.

And that vibrant Solana community spirit? No matter how hard I try to find it, It's just not there. The classic web3 vibe is replaced with the rigid, nerdy The Big Bang Theory household feel. Not saying that's a bad thing (It's a bad thing..) but Marinade has a chance to embrace community content fully, welcoming newcomers to the technical world with open arms.

But let's not overlook the brilliance that's already been achieved. Marinade's core function—liquid staking—is executed with precision, showcasing the team's sharp minds at work. Trust in their expertise is natural, and as they chart the path forward, it's worth noting that innovation will be their compass. There's a dire need for fresh ideas! engaging products and activities... (Sorry I digress).

So, as Marinade Finance sets its sights on the future, one can't help but wonder about untapped potential. The branding is strong, but there's room for widespread community engagement through content and interaction. A stronger community vibe can only broaden their impact.

I did a video deep dive overview of this deep dive.

For 2 reasons:

I want to maximize the value of this page.

For people like me who prefer listening or watching when learning.

After much thought about the last sentences of this article.

'The Marinade team are smart, very smart. I trust smart people, perhaps you should too.'

Check out their documentation here

REFERENCES

Website: https://marinade.finance/

X: https://twitter.com/MarinadeFinance/

Discord: https://discord.com/invite/QU3acbjFem

Github: https://github.com/marinade-finance

DefiLlama: https://defillama.com/chain/Solana